How to value a startup

There is no set formula for valuing a startup. It’s part art, part science. For early stage startups, especially those looking to raise, an accurate valuation is critical. Miss the mark and it can give your startup a shaky foundation on which to build from.

The two questions we get asked most commonly about valuations are:

– From founders – how do I value my startup accurately?

– From investors – how can a startup barely making any revenue, be valued in the millions?

Watch this video as Steve, Stew and An share their thoughts on startup valuations.

The importance of getting your startup valuation right.

Too high….

We see between 5-10 pitches a week from early stage startups seeking investment. When selling your vision to an investor, there’s nothing wrong with talking yourself up (yes, do that!). But, be weary of including 5-year cashflow projects and 8-figure+ valuations in your pitch deck… here’s why…

Firstly, it’s near impossible to project 5 years out. 12 to 18 month projections are more realistic. Anything beyond this will be given little weight in reaching a valuation figure.

Secondly, a high valuation will make the ‘entry price’ for investors coming into the round unappealingly high as the potential upside is relatively low. A startup with an outrageously high valuation which is not backed up impressive early traction and/or revenue might be headed for a future ‘down round’.

A ‘down round’ is where a startup is seeking further investment at a valuation lower than previous rounds, effectively devaluing the equity – this can be a company killer.

Finally, pricing your start up too high might suggest you haven’t been thoughtful in your approach. Before valuing your startup, put some time and effort in to speaking to other startups or investors and sound out what a sensible valuation looks like. Investors don’t back founders who lack self-awareness.

Too low….

A valuation which is too low puts the founders at risk of ‘diluting’ their equity too early on in the peice. As the startup progresses to future investment rounds, the founders equity will be further diluted which can leave them disincentivised.

This creates risk for the investors and founders. Founders may leave the business because the eventual ‘upside’ has been eroded. Low valuations will ultimately dilute the founders interest and will result in the same outcome as giving up too much equity too early.

Just right….

A good place to start is to consider startups in a similar industry or model to your own which share similar revenue, growth paths and models. What valuations have they presented at various rounds? This is a good place to start.

Failing that….. these are some of the factors we take in to consideration when valuing a startup.

Qualitative Factors: The ‘Art’.

For early stage startups, these are the three ‘qualitative’ factors we consider…

Team:

A team with previous successful startup experience can attract a ‘founder premium’. A startup at a pre-seed or seed stage will achieve a higher valuation than it would typically otherwise if the founding team have a proven track record with startup success or a unique skillset that gives the startup a competitive edge.

Want to know what other qualities we look for in founders? Watch this video.

Timing:

Have factors converged in your industry which have created a unique opportunity? New technologies, shifting consumer perceptions and regulatory changes all play a part in shaping the macro environment your startup operates in.

Take a look at the ‘sharing’ economy for example. Early disrupters like AirBnB and Uber paved the way for a bunch of new startups who benefited from increasing consumer acceptance of new sharing models over traditional hotels and taxis.

Initially, regulators were slow to react to these models but we’re now seeing barriers to entry from regulatory changes increase. Timing is everything!

TAM (Total Addressable Market):

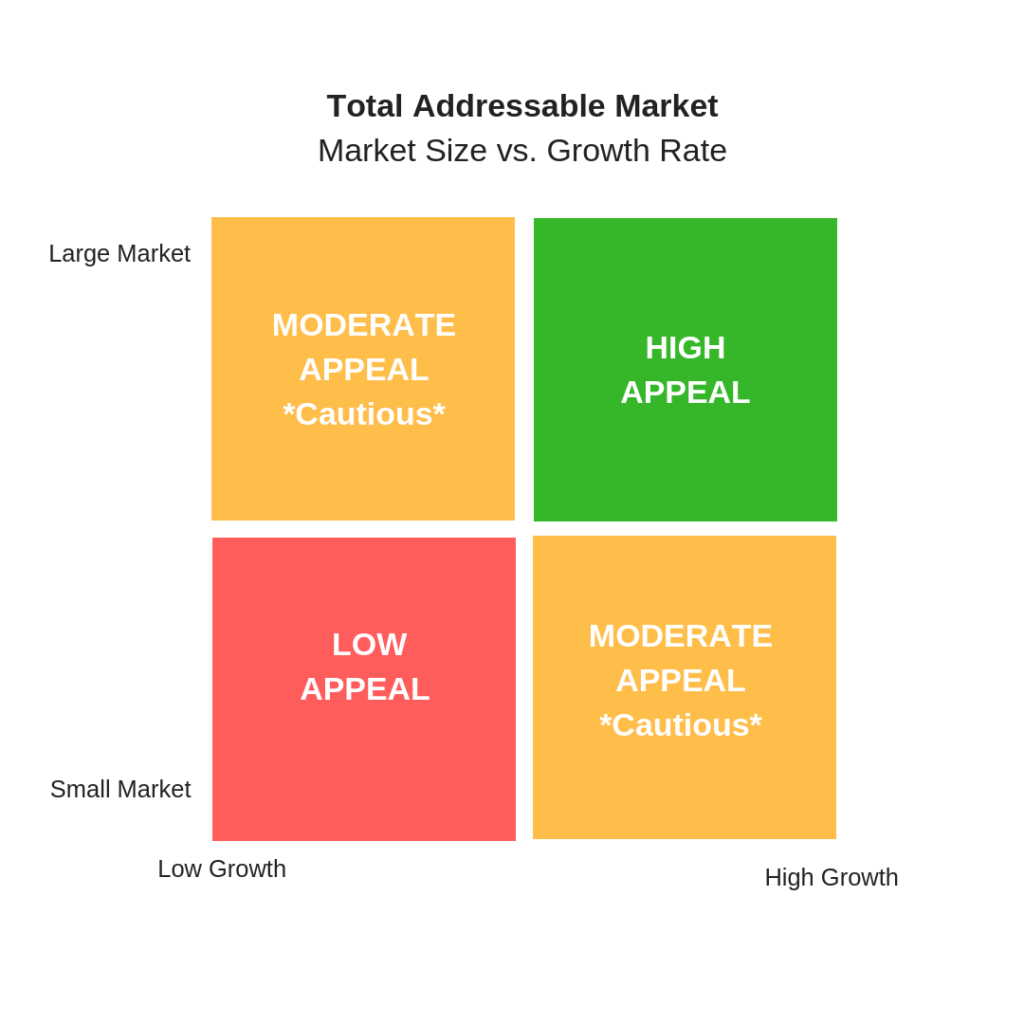

When looking at the total addressable market, there’s two variables to consider:

1. Absolute size of the market : Large (global) vs Small (local)

2. Rate of growth : High vs Low

A large, fast growing market, even with increasing rates competition will be most appealing for investors. The potential upside for a ‘winner’ in conditions like these can be huge. Startups in the green quadrant (above) are more likely attract a solid valuation.

The risk for startups in the orange quadrants (large market with low growth or small market with high growth) is much higher.

Quantitative Factors: The ‘Science’

For early stage startups, these are the ‘quantitative’ factors we consider….

Traction:

Traction in the form of revenue, sign ups, or for most SaaS businesses, MRR (Monthly Recurring Revenue) is one of the first things we look for when evaluating startups. Revenue is a ‘peg’ which shows how much customers are willing to pay for your product and how much market ‘traction’ you have been able to achieve to this point. Investors will look for some evidence of traction first and foremost.

Business Model – Bonus Points….

The type of business model deployed in your business can have a big impact on valuations and projections of future earnings.

Common business models include:

– SaaS:

– Marketplace

– Hardware/product

– Services revenue

Model 1: SaaS

SaaS ‘software as a service’, generate revenue by charging customers a recurring monthly or annual fee to use the software, like Netflix. There’s ample benchmark data available to compare your monthly revenue to other SaaS startups. While it doesn’t offer certainty, the comparisons do take some of the guesswork out of the process of evaluating the performance of the startup.

Model 2: Marketplace

Very often, startups who build a marketplace will quote the ‘GMV’ (Gross Merchandise Value) figure as their revenue. GMV is essentially the total value of all the goods transacted through the marketplace. GMV is relevant, but ultimately investors want to know the amount being ‘clipped on the ticket’ on the transactions. The actual revenue figure might be between 2% and 25% of the GMV.

Model 3: Hardware/Product Businesses:

Transition Level Investments has not invested in many businesses. These businesses require large amounts of working capital. Then there’s the cost of holding inventory, manufacturing and supply chain management. These characteristics make these businesses difficult to scale compared to B2B SaaS businesses, for example. For this reason, Transition Level tends to avoid hardware based businesses.

Model 4: Services Revenue

Many startups provide some form of services to compensate their comparatively small and growing MRR/net revenue to sustain them in the early phases.

It is important to disclose services revenue as this feeds into the more scientific valuation: revenue multiples. Services revenue is non-recurring and it draws staffing resources away from other aspects such as sales and product development.

It is not uncommon for a SaaS company to have an ‘onboarding’ fee for new customers, in addition to regular MRR from the contract. In this case, the ‘onboarding’ fee is non-recurring (and therefore less scalable) so has less weight on the valuation.

These are just some of the many factors used to value a startup. It’s not an exact science. Everyone will have an opinion and its unlikely two will be the same. And as Steve suggests…. there’s always the ouija board option.